Saving Up Like A Kid 💸

I'm terrible with my finances. It really doesn’t help that I suck at math and have a fear of numbers.

However, after reading ‘Your Money Or Your Life’ - I understand that being financially independent is an important prerequisite in your happiness journey. This requires you not to fear money, but to instead learn how to work with it, to get to a point where you are comfortable with having ‘enough’.

Financial Independence encompasses a lot more than having a secure income. It is also independence from crippling financial beliefs, crippling debt, and a crippling inability to manage modern “conveniences.” Financial Independence is anything that frees you from a dependence on money to handle your life - Vicki Robin, Your Money Or Your Life

I used to have terrible spending habits. I’d splurge on alcoholic drinks, shop endlessly online for clothes I’d never wear. Looking back, I will always regret spending THAT amount of money on stuff that didn’t matter - because it really set me back from my current financial goals.

Obviously, I’m smarter with my money now, and I certainly don’t waste it on such trivial things. However, I know this can be improved even more and want to further challenge myself on tightening my spending habits.

At times, I still tend to buy things impulsively, especially during those sales like Black Friday (and honestly, this has become a monthly affair by those e-commerce companies). I obviously have the cash and spending power to make the purchase - but the REAL question is: do I truly have the means to do so? Am I living within my means?

Of course, there are things that that I will very willingly spend on, no matter how expensive they are. A great example is my personal training sessions. It may be on the expensive side, but it’s something I know will benefit my health and wellbeing tremendously and thus, spending my money on these sessions are a no brainer for me.

To deter myself from impulsive spending, I’ve decided to try out a simplistic method for whenever I have something on my ‘want’ list.

I’ve decided to start saving up for stuff, as if I were a kid.

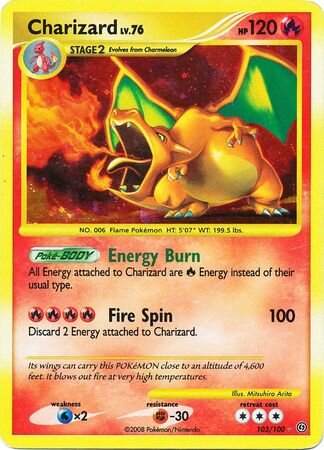

Remember how when you were young, you’d have to save your pocket money for that SUPER RARE Pokémon card? I’m going to try to apply the same principles here. You want it? You’ve got to make the effort to save up for it!

Here are some questions I’ve put in place on deciding how to spend my money:

1) What are my non-negotiables?

What are things I absolutely need to spend on and what are my wants? (Spending money on gym / groceries vs. buying a new electronic item or more clothes)

2) If it is a ‘want’, I’ll assume that I earn about SGD 20 dollars a day, and save up accordingly to the price of the item.

So if I want to buy something that costs SGD 300, I’ll have to wait 15 days to buy the item.

This simplistic method also teaches me the discipline and value of being patient. The more expensive the item, the longer I have to wait - which honestly makes it THAAAT much sweeter when you finally buy the item you want! Sometimes, if you wait that long, you may discover that it is an impulse buy and decide not to buy the item anymore!

I’m going to try this out over the next few months to see if it really works!

How do your purchasing decisions look like? I’d be keen to know, so please share it with this financial noob!

Till next week!

Jamie

-

If you enjoyed this article - there’s a high chance you may also appreciate the content shared in my weekly email newsletter: FOR THE MILLENNIAL

Every week, I send out a newsletter with some learnings and interesting stuff that I've encountered throughout the week to help Students and Millennials lead a happy and healthier life. Please consider subscribing here!